In modern banking, generative artificial intelligence (genAI) has become a catalyst for transformation. It goes beyond standard data processing and uniquely shapes the ideas, decisions, and opportunities that shape the financial field. Generative AI in banking can recognize and prevent fraudulent operations, optimize activities, and improve client interaction.

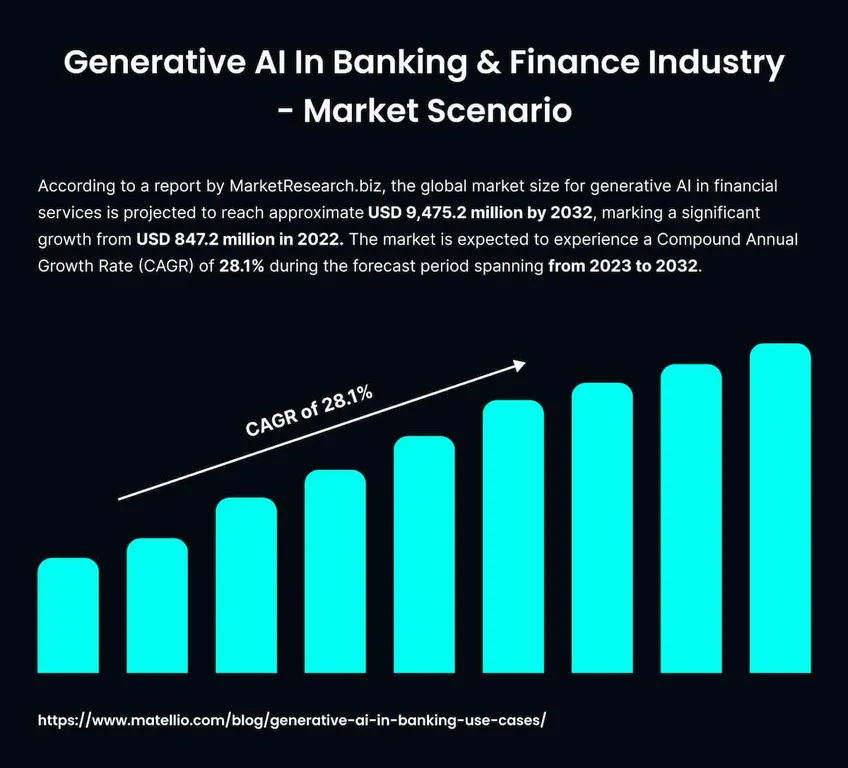

According to MarketResearch.biz, the worldwide genAI market in the financial area will increase from $847 million in 2022 to $9475 million in 2032, with a CAGR of over 28%. This reflects the rising demand and use of genAI in all fields. This blog post will look at the features and examples of intelligent solutions adopted in banking.

The Definition of GenAI in the Financial Field

GenAI in the banking field is the application of intelligent computer solutions that make banking more efficient, individualized, and innovative, making your staff’s life more straightforward.

Think of genAI as a virtual banker that can do more than keep track of capital and move funds from one account to another. Smart tools may generate unique ideas and non-standard solutions for routine banking objectives. They can formulate personalized investment tactics based on your business purposes or help create original financial products that meet the needs of particular client groups.

Generative AI in banking will help interact with clients by answering various questions, solving problems, and offering a search for fraudulent schemes. It’s like working with a financial specialist who never gets tired and can do his job around the clock.

GenAI is a powerful instrument that will revolutionize banking by making it more efficient. Financial institutions that use such solutions have every chance of long-term prosperity.

Benefits of Adopting GenAI in the Financial Area

GenAI in the financial area can be taught to perform repetitive tasks, receive relevant information, and automatically perform approvals, discovery, evaluation, and other activities. This frees staff, allowing them to focus on more critical and creative objectives. According to McKinsey, the first large banks to implement smart automation were able to free up approximately 100 million work hours each year. Let’s consider other advantages of generative AI in banking:

- Improved decision-making: Bankers who work with funds and other financial participants support their decisions with analytical insights provided by genAI. They utilize artificial intelligence in finance to decrease risks and maximize opportunities in volatile market conditions.

- Customized user content: Clients don’t have to use standardized services or wait long for support. They can access personal data anytime on the website, in the application, or through other channels.

- Maximum efficiency: GenAI technology enables financial institutions to scale their operations and overcome bottlenecks that complicate manual processes. They adopt genAI systems to automate resource-intensive processes so financial professionals may offer more excellent value to clients.

- Security: Banks use smart solutions to protect clients from risks associated with data leakage. At the same time, genAI allows financial institutions to remain flexible when responding quickly to threats. You can detect and stop any fraudulent activity.

- Regulatory compliance: Banks using generative AI verify compliance with applicable laws. GenAI automates jobs previously performed by live agents to reduce costs and avoid penalties.

Surveys show users feel more comfortable and secure handling financial matters with genAI. They may not provide personal information and may ask you to delete the conversation after it is completed.

Use Cases of GenAI in the Financial Area

A McKinsey study analyzes the potential of GenAI and highlights 63 applications across different business functions. We’ll look at basic generative AI use cases in banking domain:

- Fraud detection: Cybercrime is on the rise. Expenditures to combat such fraud are projected to increase from $6 trillion in 2021 to $10.5 trillion in 2025, increasing the concentration on data security. Generative AI in financial services suggests solutions that closely monitor operation details and define anomalies, minimizing manual oversight and errors.

- Risk assessment and management: GenAI finance allows companies to assess and respond to risks effectively and proactively. By processing colossal databases containing market data, news, and regulations, smart systems can detect early signs of emerging risks. The systems also run simulations to predict the consequences of different scenarios, allowing financial institutions to optimize risk management tactics.

- Personalized customer service: Chatbots engage users in natural human conversations, providing 24/7 support. They recognize context, sentiment, and linguistic nuances to make communication seamless and personalized.

- Algorithmic trading: GenAI solutions may compose synthetic data, effectively model market dynamics, formulate investment tactics, and provide effective portfolio management. The adoption of generative AI in finance promises to improve the quality of financial transactions, positively influencing trading algorithms and investment portfolios.

- Summarizing a considerable volume of documentation: Banks deal with various statements and papers. To decrease operational expenditures, banks may implement genAI to interact with a massive volume of information, find essential insights, and summarize them for verification. You can adopt smart systems to summarize the history of communication with the client and resolve any issue faster.

- Financial forecasting: An IBM study demonstrated that AI-backed economic forecasting decreases the risk of errors by 20% in financial organizations. Smart systems process historical data, find patterns, allow banks to model multiple scenarios, and create corresponding algorithms.

Such use cases demonstrate the potential of generative AI in banking to change the banking landscape. As technique advances, the opportunities for innovation in the financial area are endless.

Real Examples of Utilizing AI in the Banking Area

Real examples showcase the beneficial effects and opportunities that genAI brings to the financial sector. Let’s look at how central global banks utilize these structures:

- Wells Fargo Banking predictive option: This AI-backed application provides personalized account data and offers customized recommendations based on customer information. By launching such software, users get access to more than 50 various tips based on past interactions. Wells Fargo is aggressively expanding functionality to small businesses and credit card customers to expand genAI’s revolutionary impact.

- Aiden from RBC Capital Markets: This system uses deep reinforcement learning to make smart decisions based on real-time market information and instantly adapt to novel insights. RBC Capital Markets is actively expanding its AI-backed virtual trading platform in European countries, demonstrating the growing adoption of gen AI in banking.

- AI-solution from PKO Bank Polski: The most prominent Polish bank has implemented AI-backed solutions to improve the quality of client service and optimize banking procedures. The bank has added conversational AI, chatbots, and document analysis tools to provide users with the perfect personalized experience. PKO Bank Polski has also added genAI tools to automate and improve internal processes, e.g., loan underwriting, risk assessment, and mortgage approval.

- Morgan Stanley’s chatbot: The financial conglomerate implemented a smart chatbot powered by OpenAI to make life easier for its advisors. The system was tested with 300 specialists to help the corporation’s 16,000 consultants use the financial institution’s extensive research and information databases. This chatbot is a super smart assistant. It utilizes the latest systems to provide instant responses based on the banking database, which reduces the number of errors. The bank has specialists who check the correctness of the answers.

Today’s smart applications demonstrate genAI’s potential to transform the financial and banking sectors, raise client satisfaction, and improve operational efficiency.

Key Challenges with Using Generative AI in Banking Sector

Given that genAI remains a relatively new technology in the banking environment, it has some limitations that cannot be ignored:

- Information confidentiality: GenAI is data-driven, and large datasets come with significant responsibility. Banks must guarantee the security and confidentiality of client information.

- Compliance with regulatory directives: The banking sector has strict norms, and compliance is non-negotiable. Adhering to existing standards is critical when implementing AI systems. Any violation may result in severe fines.

- Bias and fairness: GenAI models can inherit bias from the datasets they utilize to train. In the banking area, this can lead to discrimination in providing loans or other financial services. Constant monitoring and improvement will allow us to create a transparent and fair genAI solution.

- System implementation and change: Synchronizing genAI with existing banking applications can be challenging. Besides, staff must be trained, changes must be monitored, and the smart solution must complement and not destroy existing processes.

Balancing profits and risks is critical for financial establishments that want to utilize genAI effectively.

How to Implement genAI in Your Financial Organization?

The adoption of generative AI in banking requires careful strategic planning and analysis. Let’s examine a few recommendations that will help lay the proper foundation for the effective use of smart instruments.

Highlight priority sectors and main objectives

As with any innovation framework, financial institutions need to have a transparent roadmap to align their efforts and business impact:

- Identify priority areas (activities or departments) where you can profit most from smart technologies. You should also plan particular use cases, such as client interactions or detection of regulatory changes.

- Clearly define your goals and expected results.

- Assess whether your existing infrastructure is compatible with genAI, assessing staff skills, data quality, and technique compatibility.

It’s essential to clarify why you want to add genAI to your organization.

Infrastructure improvement

Explore actual types of infrastructure that effectively cooperate with genAI structures. A popular solution today is hybrid infrastructure, which allows financial institutions to collaborate with private information privacy systems and harness the potential of the public cloud.

Test the technology

We recommend starting with a pilot project to determine whether implementing an AI tool is realistic, study possible risks, and evaluate the impact. Train genAI systems, deploy them, and test their functionality on a limited scale before implementing them into your bank’s most critical areas of operation, including loan underwriting or investment tactics. After analyzing the effectiveness of small projects, you can understand whether your enterprise is ready for genAI apps that will completely change its activities.

Constantly monitor genAI results

As we remember, generative AI creates certain risks for banks, financial establishments, and the economy as a whole; organizations will have to develop innovative governance structures and a set of AI monitoring instruments, both for internal use cases and third-party systems, to ensure responsible application of AI. This is relevant for unregulated procedures, e.g., interaction with clients and regulated processes, including identifying credit risks.

To successfully adopt the genAI model, you should focus on these main points. Banks need a clear action plan, including a detailed description of each stage, to form a reliable basis for implementing advanced smart systems. If you do not have experience in this industry, it is better to entrust the work to qualified developers.

Final Words

As we see, to survive, financial institutions must learn how to use automation tools properly. If you ignore such opportunities, you will lose your leading position in the industry. Since genAI is still in the early stages of its development, now is the time to explore how to adopt such systems into your business.

MetaDialog offers AI-backed solutions adapted for various areas, including the financial and banking fields. If you want to improve your finances, we’re here to help. If you want to improve your finances, we’re here to help. Contact the MetaDialog team now to discuss specifics of your business and choose an appropriate solution.