According to McKinsey & Company estimates, by 2030, AI implementation in the economic field is expected to create $1.2 in value. AI has a significant effect on the economic sector, changing the structure of the financial environment and various elements of working with capital. Adding AI-backed instruments provides substantial profits in monetary matters, so many use cases for AI in finance today will be game-changers shortly. Let’s discuss the features of machine learning and AI in finance and the industry’s difficulties.

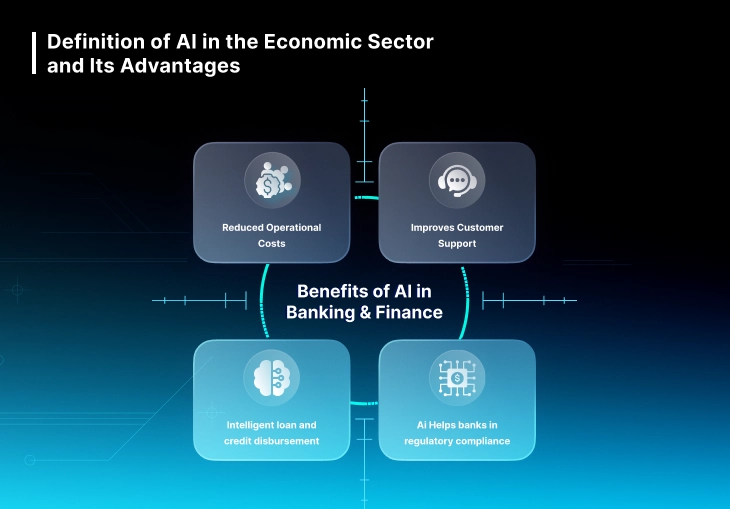

Definition of AI in the Economic Sector and Its Advantages

Artificial intelligence in finance allows you to obtain useful insights for studying data, determining performance levels, forecasting, working with clients, etc. It is a set of techniques that enable economic institutions to understand market conjuncture and human behavior better and learn from advanced algorithms. AI is taking part in many financial processes, imitating human conversations and collaboration at scale. Let’s consider other benefits of AI in finance:

- Transaction improvement: artificial intelligence techniques make optimizing and automating various financial procedures possible, increasing operational efficiency. AI-backed document automation expands digital interactions and streamlines information entry and document verification.

- Cost reduction: AI lets economic organizations decrease expenditures by automating time-consuming procedures and reducing human errors; this expands AI use cases in finance.

- Fast decision-making: AI can process valuable data in real time so economic firms can make informed decisions.

AI-backed systems help firms manage and reduce risks related to investments, lending, and other financial activities. Advanced tools process historical data and track market trends to reduce the probability of capital losses.

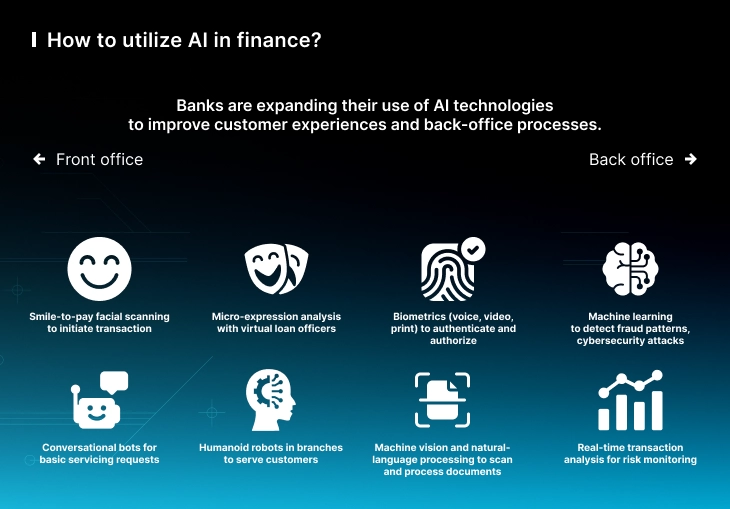

How to utilize AI in finance?

Technological advancements, customer acceptance, and regulatory changes will accelerate business organizations’ decisions to add artificial intelligence in the future. AI solutions in finance help banks simplify complex procedures and perfect the quality of interaction with clients, providing constant access to accounts and advisory services. Let’s look at how is AI used in finance:

- AI in lending: it is one of the most popular use cases when we speak about AI-backed systems. Machine learning (ML) and pattern recognition tools allow firms to go beyond standard tracking of credit ratings and credit histories and more accurately assess the creditworthiness of applicants. One striking example is the Upstart system, which allows you to approve more applications and reduce the risk of default and fraud.

- AI in client service: AI-ruled chatbots are ready to provide users with personalized economic recommendations, answer customer questions, and automate routine processes, e.g., opening an account or entering additional customer data. The KAI chatbot from Mastercard Corporation helps customers find their current account status, view transaction history, and study expenditures; it is available via SMS and instant messengers.

- Bad debt forecasting and handling: experts have created powerful instruments for bad debt forecasting. To identify possible default rates, ML-ruled structures can process historical data, including user payment schedules, credit ratings, and economic parameters. Managers of financial institutions can take preventive actions to reduce the rate of bad debts.

- AI in fraud detection: fraud creates many problems for banks and other financial institutions, so it is not surprising economic organizations are adding modern techniques to avoid it. These AI-backed systems range from identifying anomalous transactions to detecting suspicious and potentially fraudulent activity by analyzing large volumes of data. JP Morgan Chase has implemented a unique ML-ruled solution, which allows the bank to process up to 12,000 contracts in 1 second.

One of the most promising AI use cases in financial services is algorithmic trading. AI revolutionizes securities trading with advanced functionality by enabling fast and exact data-driven decision-making. AI-backed structures may analyze a massive volume of market information, such as price trends, market parameters, and economic conditions, to find patterns and forecast future trends.

AI-Related Problems in the Economic Field

A recent research by Business Insider demonstrates AI in finance could save banks and economic institutions $447 billion in 2023. However, such an active use of modern platforms in the economic field has led to several problems, including:

- Data quality: the precision and efficiency of AI-backed structures primarily depend on the quality of the information that is utilized in training. Low-quality insights can lead to low accuracy of results and a lack of accurate forecasts. According to a recent Deloitte study, information quality issues are among the top three reasons AI automation fails to achieve its goals.

- Model bias: errors in systems can be caused by various factors related to the quality and representativeness of data, choice of functionality, etc. A National Bureau of Economic Research study found that some AI-backed mortgage lending algorithms discriminate against black and Hispanic applicants.

- Information security: cybersecurity risks may arise during different phases of AI implementation, including information gathering, model construction, and adding it to an existing ecosystem. A criminal can attack an economic organization’s information base to manipulate the insights that are used to train AI, compromising the correct operation of AI instruments.

As the popularity of AI in finance industry continues to increase, so does the need to ensure systems comply with existing guidelines. Compliance with standards is key to maintaining client confidence and ensuring economic structures’ safe and uninterrupted operation.

Final Words

AI in finance provides real-time processing of significant volumes of data, allowing economic organizations to make quick and informed decisions. MetaDialog actively cooperates with firms that offer financial services, helping them solve complex problems in the AI environment.

Since the firm is a technical innovator, it is a reliable counterparty for economic organizations that plan to introduce modern technologies into their activities. Our practice and knowledge are critical to guarantee the financial services area has all the necessary instruments and resources to compete globally.