The financial sector has benefited from implementing Artificial Intelligence (AI) solutions. Banks made digital assistants an integral part of their workflows. This approach helped them automate tasks, improve interaction with clients, and ensure high satisfaction levels. Customers interested in personalized services are willing to pay more to companies that meet high requirements. Phone support allows individuals to solve problems quickly, which is why many consumers prefer to use it when facing complex issues. In this guide, we will explore how the deployment of a voicebot in banking allows companies to handle incoming queries more efficiently.

What’s a Voicebot?

The term refers to a natural language bank assistant built to answer queries and maintain natural-sounding conversations with consumers. They understand questions spoken in human language and generate voiced replies. Complex voicebots interpret sentences in a relevant context and detect subtle signs of dissatisfaction. Instead of providing generic replies in an unnatural voice, they generate comprehensive audio responses and offer valuable insights.

Banks deploy voicebots to handle various tasks:

- Answer routine questions.

- Check balances.

- Warn clients about potential fraudulent activities.

- Help customers pay bills.

- Provide information about an account.

The usage of AI in the banking sector enables organizations to free up their staff members, streamline processes, and augment client experience. Unlike traditional voice systems, algorithm-based voicebots utilize NLP, speech recognition, and ML technologies. It allows them to understand context and interpret sentiment. When communicating with them, one rarely notices any difference from human agents.

Digital assistants maintain engaging conversations and improve performance over time. They analyze high volumes of historical data and escalate cases when facing a challenging situation. Besides, voicebots integrate perfectly with AI systems designed to provide support across multiple channels.

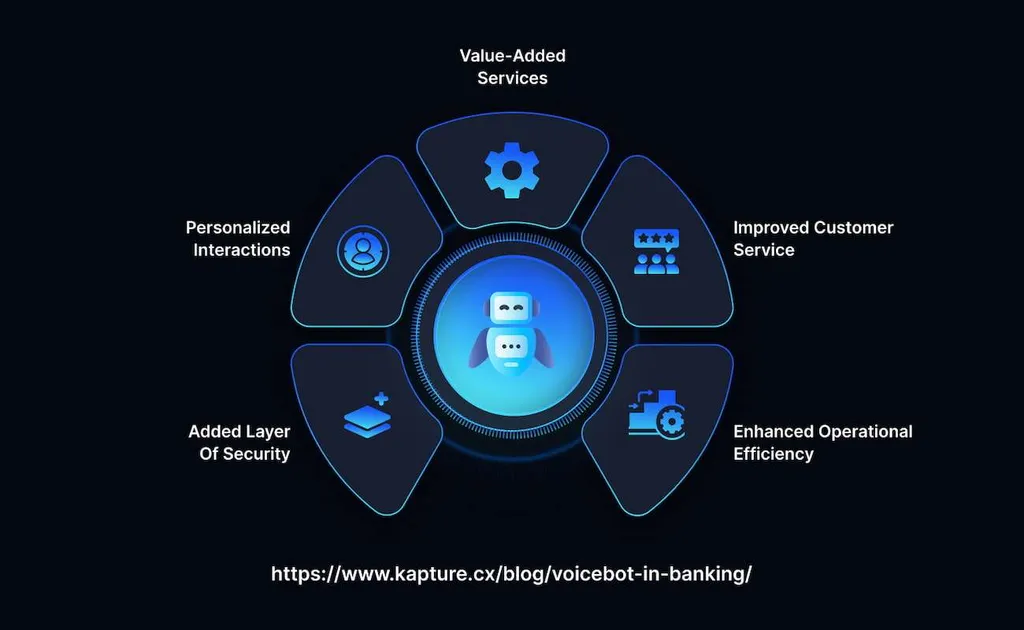

Benefits of Using Voicebots in Banking

AI-powered voicebots permit banks to optimize internal workflows and provide conversational banking services to clients. Even though building powerful Large Language Models (LLMs) requires a significant investment, their implementation enables organizations to become more sustainable. Below, we have briefly outlined the main advantages of algorithm-based tools.

Personalized Conversations

Clients have high expectations when they start to use banking services. They want to access savings accounts via intuitive apps and get immediate answers to questions. The deployment of AI bots allows banks to tailor outputs depending on a conversation history with a particular user. AI bots analyze the past interactions and generate helpful recommendations. Besides, they detect current trends and anticipate a person’s needs.

Multilingual Support

The usage of generative AI in banking enables entities to serve users in their native languages. It facilitates providing assistance to a diverse audience and expanding the scale of operations. Banks can set a foothold in new markets without hiring new staff or spending a lot of resources on re-training employees.

Efficient Self-Service Platforms

Many people prefer to solve problems without external help. When using self-service portals, they contact AI voice assistants to get information about a balance, transfer funds, and perform other tasks without relying on human agents. Voicebots solve several queries at once. Solutions developed by reputable service providers like Metadialog improve a CS team’s productivity by 5 times and provide up to 81% of automated replies. Besides, AI systems offer 24/7 support and reduce the average resolution time to 20 seconds.

Timely Alerts

Voicebots automatically send notifications about the account balance, notify users of suspicious transactions, warn them about the signs of fraud, and inform them about special offers. It allows users to spend less time managing accounts and keeping operations in order.

Cost Efficiency

Banks do not need to hire a large support team. Due to automated solutions, they handle simple tasks automatically. It enables employees to focus on high-priority queries that require human intervention. Organizations rely on algorithms to reduce expenses on banking customer service and scale up operations during peak times, while maintaining the high quality of their services.

Protection Against Fraud

Voice recognition technology allows organizations to verify customers better. AI systems detect suspicious transactions and other problems that might indicate that an account was compromised. They notify customers and employees about uncommon patterns. It prevents money losses and keeps users safe.

Valuable Data

A voice assistant collects valuable insights, helping banks make weighted decisions about developing new products. Organizations use this data to identify possible areas for improvement, eliminate bottlenecks, and enhance the quality of the services they provide.

Regulatory Compliance

The banking industry is heavily regulated, so it’s crucial to adhere to existing procedures to stay compliant. Voice assistants validate information about transactions and provide advice following the official policies. It diminishes the risk of legal disputes and costly mistakes that may result in penalties.

Common Issues Associated With Voicebots in Banking

Organizations have to deal with multiple challenges when making AI tools an integral part of their systems. Below, we have outlined some typical issues one has to deal with when deploying such solutions.

- Potential biases. AI tools are trained on specific datasets. If their quality is low or if they under-represent a particular audience segment or demographics, their replies can be inaccurate. Historical data may contain mistakes. When AI bots make decisions based on this information, they may generate wrong recommendations. Voice systems may fail to recognize specific accents and provide high-quality services. Banks analyze customer interactions to check if the training data they use includes only accurate information. They follow strict ethics guidelines and supervise AI interactions to improve their quality.

- Low trust. Many individuals prefer to be served by human employees. They mistrust AI-powered systems and consider conversations with chatbots too impersonal. Banks have to demonstrate that voice AI bots can provide relevant responses and address issues more quickly. Besides, they should be transparent regarding the use of consumer data and guarantee that it won’t be accessed by third parties. Users should be able to choose a communication method.

- Integration with legacy platforms. A bank is required to have a team of engineers with an extensive level of expertise to link AI bots with the systems they use. Entities that use outdated software may find it expensive and time-consuming to build and deploy voicebots powered by AI. Many banks entrust this task to vendors to save costs, reduce downtime, and streamline the implementation. It allows them to optimize operations without disrupting workflows.

Addressing these issues is necessary to facilitate the adoption of AI and foster trust among clients.

How to Use a Voicebot in Banking

When deployed in the right way, voicebots can significantly streamline banks’ interactions with clients. However, one should train such systems to optimize their performance. Here are the main steps banks need to take to utilize algorithm-based assistants:

- Consider your needs. Banks consider the client’s journey and identify the obstacles a person faces when using their products and services. Instead of deploying generic solutions, they fine-tune AI systems depending on unique needs and ensure that AI tools will positively contribute to processes.

- Train a voicebot using industry-specific data. Institutions collect large volumes of information. Digital assistants should be able to access it whenever they need it. This data is typically cleaned and organized for better training. Voicebots should have an extensive vocabulary, understand an intent, and have in-depth knowledge of a bank’s products. Continuous learning allows them to improve accuracy when analyzing new data.

- Prioritize personalized services. Many providers offer financial services to clients. Banks must build stronger relationships with the audience to improve the retention rate. They should train voicebots to build engagement. It will enable these digital assistants to offer tailored recommendations and remember past conversations with users.

- Build a multi-channel support system. Consumers often switch between different communication channels. Brands should improve the accessibility of their services by offering support through multiple channels, including apps, live chat, phone, and website. A voice assistant should have access to the information provided by a customer through other channels.

- Organize training sessions. Employees should learn how to use voicebots and tackle complex queries that require human expertise. Show them how to utilize AI to reduce their workload and focus on priority queries.

- Educate the audience on AI voicebots’ efficiency. As many people mistrust algorithm-based tools, banks should emphasize the convenience of such solutions and highlight their value. They have to maintain full transparency regarding the use of personal data and provide tutorials to teach people how to utilize voicebots.

- Analyze feedback and train a bot. AI systems can significantly adjust their performance over time when they process new training data. User feedback allows them to provide top-quality services.

This approach permits organizations to leverage voicebots with maximum efficiency and reduce overall expenses.

Voicebot Applications in Banking

AI bots automatically provide detailed information about transaction history and account balance. They help users analyze spending habits, schedule payments, receive receipts, and get notifications about bills that require attention. Here are some other ways to utilize voicebots in banking:

- Streamlined credit card operations. Bots can freeze a card per its owner’s request if it was stolen or misplaced. They order replacements, adjust credit limits, and perform other tasks.

- Portfolio management. Asset holders utilize voicebots to receive portfolio status updates, access expert advice, get notified about upcoming dividend payments, and confirm trades.

- Loan processing. Users deploy AI voice tools to apply for loans, manage mortgage applications, get information about current rates, and learn whether they meet eligibility criteria.

- Fraud protection. Bots make verification calls, confirm a user’s location, and contact clients to notify them of dangerous activities.

The development of speech technology permits banks to provide services across borders and streamline foreign currency exchange. Clients use them to find local ATMs when traveling and expedite international transfers.

Final Thoughts

Implementing a voicebot in banking systems requires solid expertise in algorithmic tools. Voicebots send tailored offers, optimize fund transfers, and streamline asset and account management. These cost-efficient solutions help companies provide an enhanced banking experience. Such digital assistants often become a part of larger AI systems powered by advanced algorithmic models.

Metadialog offers a range of conversational AI development services. We build custom LLMs and integrate them with legacy systems to help organizations provide personalized support. Such systems streamline daily operations and enable companies to improve the response speed of their CS teams by 2 times. Contact our team now and discover how to deploy AI-based tools to boost revenue and improve retention rates.