From improving trading strategies to strengthening security, the applications of Generative AI in financial services are vast and transformative. The usual mechanisms of business activities and corporate decision-making can change thanks to it. Artificial intelligence has countless benefits for improving fin services and regulatory compliance. In this article, we’ll define generative AI, show a few illustrations of how it’s applied in finance today, and define the four domains of how AI may revolutionize your services.

What Is Generative AI?

Generative AI is a new type of AI that interprets information and makes unique content. ML, deep learning, and AI are all merged here to create text, video, audio, and pics. The scope of using gen AI in banking sector and FinTech is expanding. It starts from financial services customer service (chatbot personalized marketing) to internal risk control processes (operations automation, analysis contracts, risk management).

Why Is Generative AI Important for Finance?

AI offers financial services a scope of benefits. According to Forbes, 65% of top financial managers believe using AI would result in progress. Gen AI generates new network material, whereas conventional one concentrates on predictions or classifications grounded on already-existing info.

Financial institutions may swiftly respond to various financial questions by optimizing LLMs (e.g., BloombergGPT) with abundant historical data. Quick responses to questions about products are possible thanks to LLM’s training on past interactions and product info. Simultaneously, the LLM can identify potential money laundering operations if it possesses ten years of Suspicious Activity Reports (SARs).

Leading enterprises have an early edge over startups in the fight between established firms. They can promote new product releases and operational enhancements using confidential financial info. Strict privacy and accuracy standards, however, can impede their advancement. On the flip side, novice firms may begin by training models with government economic data, progressively producing their data, and utilizing AI to launch novelties.

4 Domains Where AI Changes Your Finance Business

The fintech sector is ready to use gen AI to grow the scope of its operations. Let’s look at the most critical spheres where AI may thrive in the context of finances.

Individualized client experience

Over the previous ten years, fintech startups have been on the increase. Nevertheless, they did not fulfill their primary need – to automatically streamline customer financial reporting without human interaction. The gap arises from the inability of traditional interfaces to grasp the human subtleties that impact financial decisions. Furthermore, they can’t direct clients through cross-selling and referrals properly.

Let’s dwell on paying the bills as a primary challenge. Because consumers prioritize utility and brand, designing an experience that represents the best course of action might be a hard nut to crack. Because of this, it isn’t easy to offer, say, best-in-class credit tutoring without enlisting the help of an employee. Moreover, modern software does not solve all tax issues.

By better comprehending and navigating the financial options available to customers, LLM provides AI for financial operations solutions. These systems offer answers, weigh trade-offs, and consider the human context when making decisions. MetaDialog provides an LLM model that can respond to a range of use situations and function in more than one language. It gives real-time responses, deploys on-site for optimum security, and fully comprehends inquiries in context. With these features, consumer fintech should evolve from a high-value but particular scope of applications to one where apps assist users in making the most out of their financial decisions.

Better compliance

The use of gen AI in compliance departments in the future may stop between $800 billion and $2 trillion worth of money laundering worldwide annually. It will help to lower organized crime and drug trafficking. To look into transactions that have been highlighted, compliance officers now spend a lot of time gathering client data from many systems. AI brings changes:

- Effective sorting: AI in financial services summarizes crucial system information promptly. They facilitate the speedy evaluation of transactions by compliance specialists.

- Better launderer identification: Without explicit definitions, models trained on years’ worth of SARs may recognize new launderer trends independently.

- Quick document analysis: AI quickly scans large amounts of documents, including emails, reports, and contracts. It highlights potential compliance troubles to do more research. When it comes to MetaDialog LLM, it quickly reads and comprehends thousands of financial documents, raising productivity and removing the human element.

Furthermore, publicly accessible compliance data to new players speeds up search and synthesis. Nonetheless, big enterprises must use info gathered over the years to address privacy problems. Thanks to gen AI, the compliance sector is about to become more efficient instead of being a cost center reliant on outdated technology.

Reinforced risk control

Enhancing generative AI financial services won’t make risks melt away. Yet, it may assist organizations in promptly recognizing and handling risks related to credit, markets, liquidity, and operations. Here are some ways AI might enhance risk control:

- NLP and LLM models, like ChatGPT, handle enormous volumes of unstructured info (news, market reports, etc.) to offer a thorough understanding of counterparty and market dangers.

- Access to up-to-date information on global events and market situations helps you respond to changing circumstances faster.

- AI makes complicated scenarios more accessible to use for risk early warning. It makes proactive risk control possible.

Moreover, integrating AI into systems offers a comprehensive perspective on threats, enhancing risk control procedures by amalgamating data from many sources.

Dynamic forecasting and reporting

A finance LLM does more than just provide answers. It helps teams by streamlining internal procedures. Because of insufficient scientific info resources, basic jobs are still not automated. Consequently, instead of concentrating on strategic activities, CFOs lose time on laborious record-keeping and reporting duties. AI poses several benefits:

- Forecasting. Automate analysis using AI-generated formulae in Excel, SQL, and BI instruments to assist with challenging scenarios. It provides input for more complicated methods and a larger dataset of predictions.

- Reporting. AI generates text, charts, and personalized reports automatically. Because of this, manual data entry for reports—both internal and external—takes less time.

- AI summarizes and processes info in accounting and taxation. It makes the laws and possible deductions easier for accountants and tax teams to grasp.

However, because of poor accuracy, the present performance of generative AI is restricted, particularly in areas which demand correct judgment, necessitating human verification. In finance, depending entirely on AI models is still problematic, even if they are constantly improving.

Real Examples of Generative AI in Finance

Gen AI finds its wide use in fintech in numerous instances. Let’s look at the top 3 AI use cases in financial services.

Credit decisions

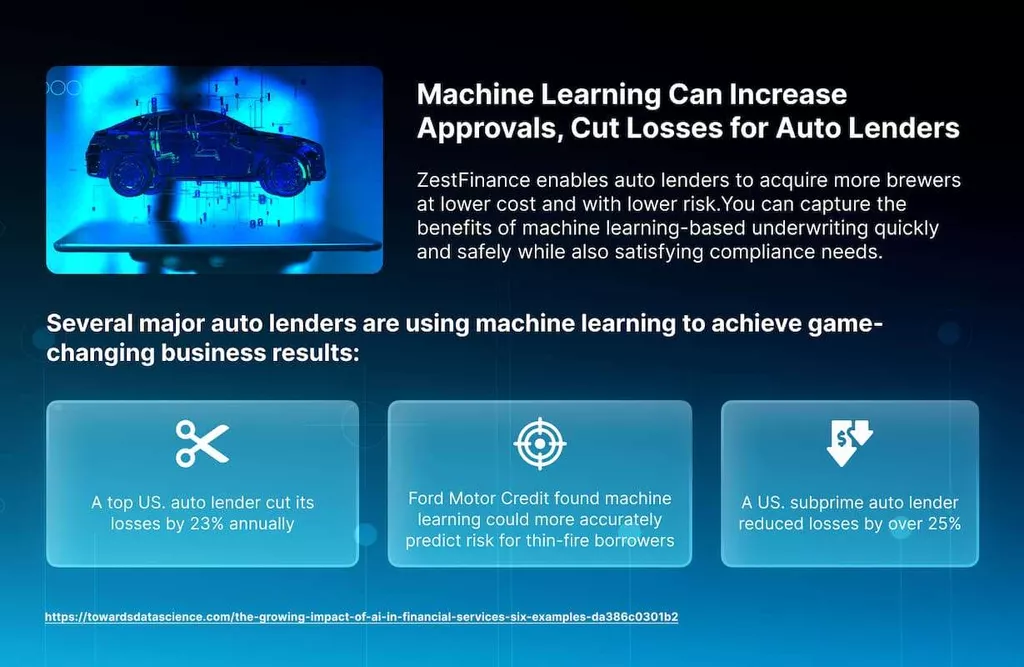

AI transforms borrower assessment by offering a quicker, more precise evaluation at reduced costs. An AI-driven credit scoring solution considers diverse factors. Therefore, it aids in data-backed judgments. It enables lenders to differentiate between high-risk default applicants and creditworthy individuals without an outstanding credit history.

Moreover, AI in financial services opens a chance to zero in on objectivity – it minimizes bias compared to human judgment. Digital banks and credit apps take the best out of the ML. They evaluate credit eligibility using alternative info such as smartphone usage. Some reports state in the car lending sector, the implementation of AI significantly reduced annual losses by 23%, demonstrating its success.

Risk management

The influence of AI on risk management is profound. Its substantial processing capabilities swiftly handle vast datasets and structured and unstructured information that would require human agents significantly more time. Algorithms scrutinize historical risk instances and spot early indicators of possible soft spots.

Moreover, AI stands out in real-time market activity analysis. When using it, you may get precise predictions and elaborate forecasts grounded on numerous crucial variables in business planning. Take Crest Financial, an American leasing company, as an illustration. It leveraged AI through Amazon Web Services and experienced noteworthy advancements in risk analysis. At the same time, the company was able to avoid all the delays that are usually characteristic of run-of-the-mill data science methods.

Prevention of fraud

AI in financial services has made significant progress in the fight against fraud. All this is thanks to ML, which is ever-increasing to counter criminal tactics. It’s effectively curbing credit card fraud, which has skyrocketed because of the e-commerce boom. Fraud spotting systems examine customer behavior, location, and purchasing patterns. They indicate anomalies and activate safety precautions. Banks use this tech to fight money laundering, with machines spotting fraudulent activity. It cuts down the price of the investigation. As reported by a study, there was a 20% decrease in investigation workload. It highlighted the effectiveness of AI in detecting and preventing financial crimes.

Conclusion

The influence of artificial intelligence in financial services is profound and transformative. It improves performance across multiple domains. As AI alters the financial environment, it offers state-of-the-art LLM models that streamline financial processes, ensure compliance, optimize risk control, and provide dynamic forecasting.

MetaDialog’s LLM solutions understand the context and offer real-time responses, transforming fintech to consumers by offering end-to-end optimization. Reap the benefits of AI with MetaDialog’s advanced solutions. Increase the efficiency, accuracy, and innovation of your financial services today.