When it comes to applying technical innovations, the financial sector is a trailblazer. It continuously incorporates brand-new methods and tech to boost precision, productivity, and efficiency. A new era of computer power has begun with the recent explosion in AI. OpenAI GPT-4 and other large language models (LLMs) are emerging as indispensable technologies. Human-machine interaction is altering, and the financial services industry is also experiencing a revolution in operations. We’ll discuss the importance of the financial large language models in this post, along with strategies for maximizing its potential.

What Is the Large Language Model in Finance, and Why Does It Matter?

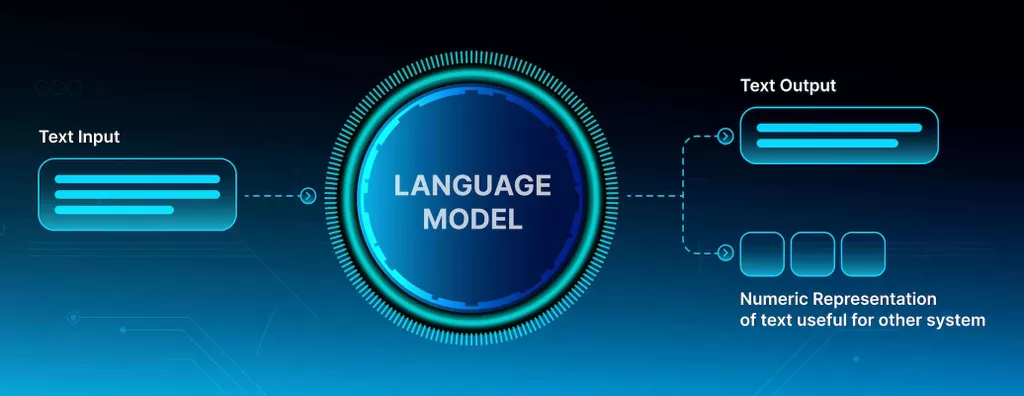

Large language models are examples of highly developed AI systems. Their purpose was to absorb, comprehend, and produce human-like content. These models are trained on massive datasets, including billions of words from various sources – books, papers, and websites. They depend on deep learning techniques. Because of this, LLMs can comprehend context, syntax, subtleties of language, and even some general knowledge.

Although AI has many imaginable applications, fintech has not yet seen a significant change. Just 20% of banks and insurance organizations consider AI use cases to be paramount to their operations, according to the UK 2022 poll. Data restrictions, a lack of skilled workers, opposition to change, and hardships in integrating AI findings into functional systems are the main obstacles facing AI as it exists now.

LLMs, nevertheless, provide a different course. These models can overcome current challenges:

- Their task involves handling unstructured data and broadening the data set for several uses.

- Their dependence on pre-trained base models makes it easier to adjust to different situations. It simplifies implementation, even for those without a lot of technical knowledge.

- Democratizing ChatGPT with OpenAI, which are examples of large language models, has increased confidence among non-technical employees and corporate executives, facilitating adoption.

- LLM outputs frequently have recognizable forms, which makes operational integration easier.

In proven application cases, this tech raises AI in finance value. It may be achieved by strengthening NLP programs with less training and more accuracy and by enriching customer service programs.

Custom training of cutting-edge big language models tailored to client requirements and data is MetaDialog’s area of expertise. These models handle several languages and produce replies for various use situations. Likewise, LLM in finance broadens the use of AI in fields like code interpretation, report creation, and financial crime investigation, which were previously considered problematic for automation.

How to Harness the Power of Large Language Models in Finance

It’s pivotal to comprehend the LLMs’ power and, most importantly, how you can harness it. Let’s touch on four strategies to help you use AI on a new scale.

Document overview and data extraction

LLMs automatically sum up the tax returns, legal papers, and financial reports. Thanks to this feature, experts can instantly access crucial info and skip the laborious process of sorting through mountains of material. Accounting and financial services firms frequently deal with enormous amounts of paperwork. Manual search becomes tiresome as a result. Nonetheless, large language models in finance lessen this load by streamlining the procedure.

AI-powered assistants can help teams get precise data rapidly. They will expedite the process of looking for and finding the required info in a couple of seconds. These models are good at gathering essential information from unstructured financial documents, such as contracts, invoices, and receipts. They streamline data entry procedures and lower the possibility of manual errors in financial accounting.

Compliance with tax legislation

If your goal is to simplify tax compliance, LLMs can be pretty helpful. With AI’s assistance, it is possible to decipher tax regulations and locate possible credits or deductions from financial data. This assistance makes it easier for businesses and individuals to file taxes quickly. While experts possess the requisite knowledge, the sheer amount of forms sometimes overwhelms them, necessitating regular attention to minute details. Conversely, LLMs excel in precisely handling a wide variety of forms. It reduces the chance of mistakes or oversights. This improved accuracy protects companies from any legal repercussions and assists them in adhering to tax regulations.

Financial consulting and customer services

Chatbots are becoming essential assistants in the banking industry, replacing client assistance at a lower cost. CNBC claims that banks like JPMorgan utilize AI services to their full potential regarding investing advice. As an illustration, MetaDialog models can provide multilingual replies and contextual comprehension. They offer real-time solutions and are tailored based on the user data.

Present-day deep learning algorithms quickly extract meaningful information in a short amount of time from massive volumes of data. It is crucial for the fin sector, as fast and correct knowledge is essential for arriving at decisions in this context. Tasks deemed challenging in the past are now attainable with the advent of the large language models in finance. It increases the possible uses of AI in finance even further.

Investment portfolio management

The large language models in banking can provide necessary support to banks that offer investing services. They can propose portfolio allocation and assess market trends. These models suggest asset allocation, diversification, and rebalancing techniques, which aid in streamlining investment portfolios. LLMs can recommend the best portfolio compositions for their customers based on various analyses, comprising past performance, volatility, correlations between assets and market sentiment, and client risk tolerance and investment goals.

LLMs help create individualized investment plans based on each client’s tastes and financial objectives. For instance, based on user-specified goals, Auto-GPT may optimize a portfolio utilizing global equities and bond exchange-traded funds (ETFs). It creates comprehensive strategies, including gathering financial information, optimizing the Sharpe ratio with Python programs, and providing the user with the findings.

Market analysis and forecasting

LLMs provide businesses with a competitive edge in market analysis and forecasting because of their capacity to sort through massive volumes of data and extract insightful knowledge. The applications of LLMs in finance will enable you to anticipate market shifts, manage risks, and make wise strategic decisions. It is possible because modern technology can comprehend news, trends, and emotions.

Summary

Even while large language models in finance have already significantly influenced the financial services sector, their revolutionary path is far from over. These models will continuously evolve to spruce up their accuracy and make comprehending language subtleties and context easier.

Consider LLMs to be more than a trend. They might represent a radical change in how your firm handles complex problems and takes massive amounts of data. Select a solution from MetaDialog to explore LLM’s potential in more detail. The modern Retriever is a novel model that pulls pertinent info from a vast knowledge base using a particular information processing mechanism. Finding and prioritizing relevant documents or data in response to a request or input of user data takes seconds.